The House

Knightsbridge Partners is a merchant bank, modeled on the merchant banks of the late 19th century-like

Rothschild, Morgan & Co. and Brown Brothers Harriman, firms that were not only considered traders and

financiers but entrepreneurs with core values and total commitment to clients that rarely exist today.

At Knightsbridge, we are strong believers in the value of partnership and we structured ourselves around

that single idea.

Whether managing investments for our private clients or advising institutional investors, our long-term view

on doing business is a distinguishing and a crucial part of our success.

Knightsbridge is characterized by the team-based approach with strong global partners coupled with the

know-how of an investment bank and our emphasis on the highest ethical standards.

Our competitive advantage rests in the combination of extensive investment experience, access to unique

investment opportunities and our vast network of powerful relations throughout Latin America, the Middle East,

North America and Europe.

Expertise

Investment expertise across private markets

Real Estate

Knightsbridge core investments have been traditionality in the real estate sector. Our firm offers clients

a combination of extensive real estate investment experience with in-depth local knowledge, formidable

execution and access to unique opportunities.

The firm is an active, hands-on investor and, with its strong financial engineering capabilities,

international partners and network, provides significant value beyond the deployment of equity capital.

OUR FOCUS IN 2024:

- Luxury Residential Development

- Marbella, Spain

- Cascais, Portugal

FUND

- Luxury Hotel & Private Residences

Private Equity

Our private investment platform, ATMOS, is dedicated to investing in the sports ecosystem. Our foremost

interests are in Football and Padel, two of the fastest growing sports in the world. The sector offers an

attractive combination of opportunities (the global sports industry takes in more than half a trillion dollars

a year) and low correlation to traditional asset classes.

At their core, sports are growth assets with compelling financial and operating performance.

INVESTMENTS:

- Football

- Padel

- Licensing

- Sport Technology

Private Capital Advisory

Our Private Capital Advisory group raises capital for major private firms as well as for entreprenuers.

We work closely with our clients in adapting their needs in an ever changing fundraising environment. At the

same time, our aim is to form long-term relationships, supporting them through succesive campaigns to raise

capital.

Our long-established global relationships include both institutional investors and over 300 family offices

throughout the Americas, the Middle East, United Kingdom and Europe.

These relationships provide us with in-depth insight into the objectives and decision-making process our our

clients, and enable us to design optimal fundraising strategies.

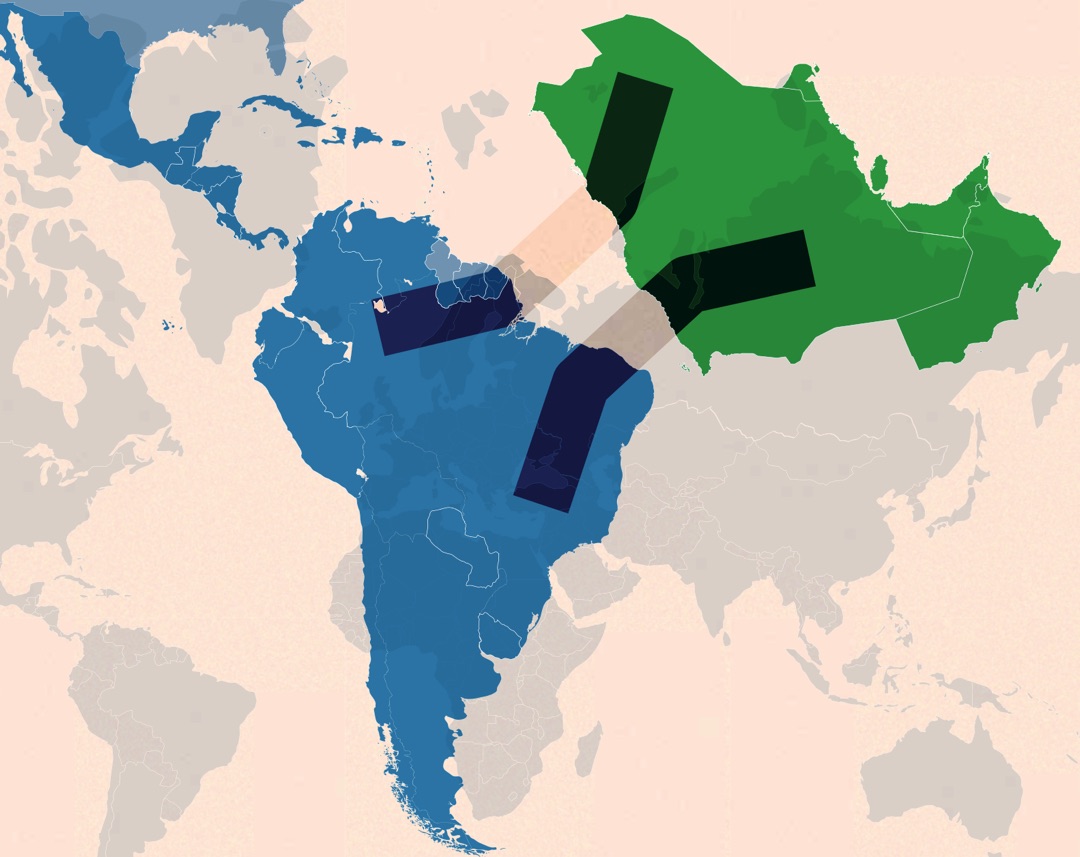

Middle East

Transformative Investments

In 2019, our Founder, Daniel Melhem established The Corniche House, an entity with the objective to challenge

the status quo and transformed the Gulf Cooperation Council (GCC) region into a powerful global manufacturing

and technological HUB.

Since then, our company has been working closely with several pharmaceutical, food, and technology companies

to established new state-of-the art facilities across the GCC.

Learn how Qatar has become the spearhead for our worldwide business partners in one of the most attractive global hubs through its unique geographical location, superb infrastructure, logistics and our access to key decision makers.

Daniel Melhem

Founder

Daniel Melhem is Founder & Managing Partner at Knightsbridge Partners. Knightsbridge is an Investment

Management firm with offices in London. Mr. Melhem has a long track record in the financial and real estate

industries.

In 2019, our Founder, Daniel Melhem established The Corniche House, an entity with the objective to challenge

the status quo and help transformed the key Gulf States: the Kingdom of Saudi Arabia, United Arab Emirates and

Qatar into a powerful global manufacturing and technological HUBs.

Mr. Melhem begun his career at Lehman Brothers in 1997 as a Financial Analyst in New York, moving to Private

Client Services as Vice President where he soon became one of the most successful financial advisors at Lehman

Brothers. In 2000, he joined Morgan Stanley and was responsible for South America.

He holds a BS in Economics and International Business from Babson College, and earned the faculty's Economic

Achievement Award. In 2018 he founded the Argentine Investment Council, Consejo Argentino de Inversión, a

non-profit organization dedicated to foster economic development and promote foreign investment in Argentina.

Mr. Melhem has been featured in several magazines and newspaper as an expert on the Argentine economy and the

Middle East, including: La Nación, Clarin, Infobae, El Mercurio, The Economist, the Financial Times, Gulf

News, among other publications, and has participated as a speaker at several conferences around the world.

We serve as superior stewards to our clients, we provide independent, discreet and innovative financial solutions.

Agustin Kluz

Managing Director, Real Estate

As a Finance and Investments professional, Mr. Kluz brings a wealth of expertise to Knightsbridge Partners.

Specializing in valuation, strategic negotiation, and financial analysis.

His role at Knightsbridge extends to providing Finance, Strategy & Implementation leadership covering all Real

Estate sectors: Residential, Commercial, Retail, and Logistics. Mr. Kluz specializes in Mixed-Use Strategies

as a Value Driver, offering product design advisory, project valuation, and expertise in Real Estate

Management and Development. Additionally, he serves as a non-Executive Board Member at Quality Invest, an

8000 unit brownfield residential development project in Buenos Aires, Argentina.

With a proven track record, Mr. Kluz has successfully managed the opportunity pipeline screening,

underwriting, due diligence, acquisition, and financing of transactions exceeding USD 500M in equity across

several international markets. His strategic approach delivered attractive risk-adjusted returns on select

markets on solid capital structures. Mr. Kluz holds a degree in Architecture from the Universidad de Buenos

Aires (UBA) and an MBA from Universidad de San Andrés. Mr. Kluz also serves as a lecturer at Universidad de

San Andrés on Real Estate and Entrepreneurship.

Waleed Arab

Managing Partner, Saudi Arabia

Mr. Arab started his career at Citibank | SAMBA Bank where he worked as a Corporate banker between 1994-2000,

moving on to the Private Wealth Management division, advising HNW individuals in Saudi Arabia. In 2000 he

joined Unilever as Brand Manager for the MENA region. As part of his growth and experience, he then joined

Philip Morris International in Lausanne, Switzerland 2005-2007, and managed the company's Easter European

markets.

In 2007 he became Managing Director of Pepsico International until 2011. That year, he moved to the UAE and

became a Director for Quilvest Group, where he represented the interests of the Bemberg family, an

international financial group based in Paris with over $20 billion in asset under management.

In 2012 he founded Karma, a firm that primarily provides corporate services (MISA, Government Relations) to

foreign companies and executives in the Kingdom of Saudi Arabia. Mr. Arab also controls a logistics company in

Saudi Arabia, which provides last-mile deliveries to customers such as Amazon, Aramex, among other companies.

He is a stakeholder in a Holding Company that provides advise in the Defense sector to the Kingdom of Saudi

Arabia.

Mr. Waleed Arab holds a Bachelor of Science degree in Economics and Business Administration from Boston

University.

News & Insights

-

On Dec. 10, 2023, Javier Milei became the new president of Argentina by an overwhelming majority after enduring a tough presidential campaign. This shock reverberated not only within Argentina’s elite but also throughout Latin America, and also stunned Washington, London, Paris and Madrid [...]

-

La empresa dueña de los shoppings tenía previsto edificar 8000 viviendas en el partido de San Martín, pero vendió su participación del megalote a una desarrolladora cordobesa [...]

-

After a humiliating defeat in primary elections on Sunday, many pundits now assume that it is game over for Argentina’s President Mauricio Macri. [...]

-

A casi tres años de la asunción de la administración de Cambiemos aún no se han podido emprender las reformas de fondo que son vitales para que la Argentina de una buena vez se encamine [...]

-

Una de las palabras más frecuentes hoy en día en importantes diarios del exterior y revistas especializadas, como The Economist, Wired y Time, es la palabra disruptiva [...]

-

La publicación subrayó la “confusión” y “sorpresa” de la comunidad financiera por la baja de tasas del BCRA, cuando el Gobierno quiere reducir la inflación anual a 15% en 2018 [...]

-

Generally speaking, today’s investors find that expected returns in Argentina are still lower than in other emerging markets. Taxes still rank among the highest in the region, and labour costs are expensive. Thus, investing here remains a difficult proposition for institutional investors, even for the most aggressive funds [...]

-

Tras la visita de una comitiva a Dubai en abril, el pasado lunes la Agencia de Promoción de Inversiones y Comercio Exterior de la Ciudad (InvestBA) y la Agencia de Desarrollo de Inversiones de ese emirato (Dubai FDI) firmaron un memorando de entendimiento para fomentar el flujo de inversiones y desarrollar una cooperación en materia de negocios [...]

-

Alejo Rodríguez Cacio, director general de la Agencia de Promoción de Inversiones y Comercio Exterior del Gobierno porteño (investBA), se reunió en Medio Oriente con dos fondos soberanos, con el fin de estrechar los vínculos entre la ciudad de Buenos Aires y los Emiratos Árabes Unidos [...]

-

This EIU report discusses the current economic and political climate in Latin America and explores sectors that present opportunities for economic growth—particularly trade-related infrastructure and the services sector [...]

-

This EIU report examines the current trade and investment relationship between the Gulf Co-operation Council (GCC) countries and Latin America and maps out engagement in key sectors and opportunities for Gulf investors [...]

-

Convencido de que así atrae inversiones, el Gobierno acapara debates y seminarios. Una consultora armó un evento sobre el país para Londres, Abu Dhabi y Shanghai [...]

-

This EIU report examines the current trade and investment relationship between the Gulf Co-operation Council (GCC) countries and Latin America and maps out engagement in key sectors and opportunities for Gulf investors [...]

-

Para muchos argentinos, la semana que comienza es una más. Pero para el futuro del país, y en particular para el de las generaciones más jóvenes, lo que ocurrirá en Buenos Aires esta semana podría tener un enorme impacto en sus vidas [...]

-

El presidente de Argentina, Mauricio Macri, inició una gira de trabajo a Catar y a China, donde participará en la cumbre del G20, con la mira puesta a conseguir inversiones para el país austral [...]

-

La semana pasada la visita del emir de Qatar, Tamim bin Hamad Al Thani, no sólo tuvo una alta expectativa en el Gobierno, sino también en los empresarios del país de la península arábiga, quienes analizan las alternativas de inversión que pueden realizarse en la Argentina [...]

-

El presidente del Consejo de Líderes del Golfo y América Latina, Daniel Melhem, cuenta cuáles son los sectores en los que invertirían estos países [...]

-

El próximo 10 de diciembre, Mauricio Macri presidirá el primer Gobierno centrista; romperá así la hegemonía radical y peronista que gobernó a la Argentina desde 1916 [...]

-

Como lo hizo en 2002 desde el banco central, el economista enfrenta una vez más la tarea de recuperar una economía golpeada por una alta inflación y un régimen cambiario caótico [...]

-

Como lo hizo en 2002 desde el banco central, el economista enfrenta una vez más la tarea de recuperar una economía golpeada por una alta inflación y un régimen cambiario caótico [...]

-

Argentina is coming under increasing pressure to strike a deal with its so-called “holdout” creditors, after the dollar-starved government failed to gain financial breathing room with a bond issue and debt swap last week. [...]

-

State-backed investments into Latin America are set to increase, as developing countries act to secure natural resources, providing the region with a vital source of revenue but also stirring political tensions [...]